The income gap

Along with terrorism, climate change, disease pandemics, and the prospect of persistently low economic growth, inequality has crept up the international policy agenda to become one of the most urgent and important issues of our time. Harvard Professor Kenneth Rogoff has argued that “income inequality is the single biggest threat to social stability around the world, whether it is in the United States, the European periphery, or China.”

Inequality has also become a centerpiece of the 2016 presidential campaign, with both the Democratic and Republican nominees focusing on this crucial issue to win over the American public. This political debate tends to focus on income inequality, but widening inequality also has worrying compounding effects that permeate other aspects of the economy, from inequality in political influence to inequality in the quality of and access to education and health care.

“…income inequality is the single biggest threat to social stability around the world…”

—Kenneth Rogoff

A few statistics help illustrate the problem. According to the Brookings Institution, for men born in 1920, there is a six-year difference in life expectancy between income-earners in the bottom 10 percent and those in the top 10 percent. For men born in 1950, that difference more than doubled, to 14 years. For women, the life expectancy gap nearly tripled, from 4.7 years for those born in 1920 to 13 years for those born in 1950. Meanwhile, just 158 wealthy U.S. families account for approximately half of the money fueling political/electoral campaigns, suggesting that political influence is skewed toward the rich, even in a democratic state.

Economic theory suggests that the relationship between income inequality and economic growth is ambiguous. Inequality in outcomes can incentivize individuals to work hard or be more productive than others in order to receive greater incomes—activity that spurs growth. Yet inequality may also limit the ability of the less fortunate to access opportunities or credit; it may cap demand, increase instability, and undermine incentives to work hard, thereby reducing economic growth. Growing inequality could also generate a relatively larger group of low-income individuals who are less able to invest in their health, education, and training, thereby retarding economic growth.

Simply put, inequality can hamper growth when poor individuals suffer from health problems and low productivity as a result of their income status, or are unable to invest in education. As we see in the current political climate in the U.S., inequality can also jeopardize public support for “growth-boosting policies” like free trade, creating a challenging and hostile political environment.

Nevertheless, according to the Organization for Economic Co-operation and Development (OECD), income inequality has increased an average of 3 Gini points across developed countries over the past two decades, and this has yielded a cumulative loss of 8.5 percent in GDP at the end of the period. [The Gini coefficient measures income inequality by measuring the distribution of income within a society. A Gini coefficient of zero expresses perfect equality, where everyone has the same income, whereas a Gini coefficient of 1 (or 100 percent) reflects extreme inequality, where income is skewed to one person and all others have none.]

In the 20-year period between 1985 and 2005, growing inequality is estimated to have knocked more than 10 percentage points off growth in Mexico and New Zealand; nearly 9 points in the United Kingdom, Finland, and Norway; and between 6 and 7 points in the United States, Italy and Sweden.

More specifically for the United States, the average income of Americans in the top 1 percent is roughly 30 times that of the average income of Americans in the remaining 99 percent. In 1978, the top percentile was just 10 times richer than the rest of the population.

To address these urgent problems, the incoming president must carefully frame the debate around income inequality. He or she should also recognize that the existing menu of policy interventions is inadequate to stem the widening inequality tide. New solutions are needed.

Fortunately, the advent of new technologies provides opportunities for the next president to push innovative ideas that address inequality by creating new avenues to build and grow small- and medium-sized businesses—and thus create jobs—and provide income growth and opportunities for more citizens.

Countering widening income inequality should be a high priority for the next president. However, there are at least four factors that complicate the income-inequality debate and cloud the direction of policy makers on how best to address the deleterious income-inequality trends. It is here that the incoming president will need to reframe the debate.

Countering widening income inequality should be a high priority for the next president.

1. Which system is best at reducing inequality?

First, compare the world’s two leading economies in terms of GDP: the United States and China. The U.S., with a GDP of over $16 trillion, has a political system based on liberal democracy and an economic ethos defined around market capitalism (even if not entirely pure), where the factors of production—capital, labor, and industry—are owned privately, rather than by the state. Meanwhile, China, the second-largest economy with a GDP of around $10 trillion, has relied on a political system that deprioritizes democracy and places the state at the heart of the economy as the main arbiter of capital and labor.

Although these two economies have completely different political and economic approaches, according to the CIA Factbook, they have roughly the same Gini coefficient of around 0.45.

Worse still, whereas China’s income inequality has notably improved in recent years—from 0.485 in 2005 to 0.45 today—that of the U.S. has worsened by approximately 5 percent over the past two decades.

The fact that the U.S. and China now have similar Gini coefficients poses a challenge for policy makers across the world (particularly across the emerging, poorer countries at the nascent stages of economic development), as it raises the question of which combination of political and economic systems can better address inequality.

Over a long time frame, the market capitalist system has, more than any other economic system, proven itself the best way to increase growth and create a greater economic surplus and a greater GDP pie. But the newer evidence from China shows that it is possible to meaningfully reduce income inequality without a free-market-based economic system or a democratic political system.

The improvements in China’s income inequality are, at least in part, due to deliberate policy initiatives introduced by Chinese policy makers. In February 2013, for example, the Chinese State Council introduced a reform plan titled the “Income Distribution Plan.” The plan is aimed at boosting minimum wages to at least 40 percent of average salaries, loosening controls on lending and deposit rates, and increasing spending on education and affordable housing, with the goal of reducing China’s income inequality. Other reforms targeted at shrinking China’s income gap include a requirement that state-owned enterprises contribute more of their profits to the reduction of inequality, as well as a commitment to push through market-oriented interest rate reforms to give savers a better return and more security.

All these measures directly reduce inequality. Yet it is not clear that the decentralized nature of the U.S. political system would support such sweeping, redistributive approaches. The incoming president will instead need to pursue more innovative indirect policy initiatives.

Similarities in income-inequality performance between market capitalist countries such as the U.S. and relatively nonmarket states such as China (where state capitalism is now the dominant economic form) are illuminating. However, relying further on the purer forms of free-market capitalism—where market factors are relied upon to match demand and supply and remedy widening income inequality—suggests no clear path to combat the worsening trend of within-country income inequality. The next president needs new strategies.

2. The inadequacy of traditional left-right solutions

This leads to the second complication policy makers are facing in their attempts to address worsening income inequality. In many democratic societies, political systems have tended to address income inequality by adopting either left-leaning tax-and-redistribute/spend policies or more right-leaning supply-side, trickle-down approaches, albeit with a lot of variation between these two extremes. Nevertheless, viewed over multiple decades, neither stance has managed to meaningfully reverse the inequality trend. In the U.S., for example, over the past two decades and despite policy interventions by both Republican and Democratic administrations, income inequality has widened over time.

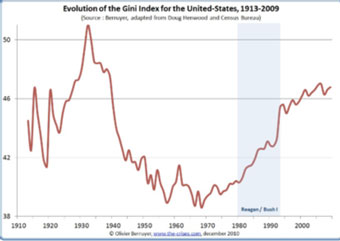

This chart shows that income inequality has progressively worsened in the United States over the last 100 years.

This entrenched trend has buttressed the idea that widening income inequality is in fact a byproduct of a market capitalist system itself—an idea that comports with evidence that income inequality has progressively worsened in democratic and free-market economies (indicated by the rising trend line in this chart), with only a brief period of improvement, over the last 100 years. While some leaders have previously tried a mixed-economy model—the so-called “third way” using traditional policy approaches from both baskets of the Republican and Democratic parties—rising income inequality in recent decades indicates that this has not been a permanent success. Simply going back to the post-World War II model of economic policy is not the answer.

3. The importance of absolute levels of income and poverty

The income-inequality debate is further complicated by a third point—a lack of consensus as to whether, and how, an unequal society actually matters for longer-term economic progress. This is a question of whether policy makers should be less concerned with income inequality and the relative income differences across the population, and instead worry more about the absolute levels of income and degrees of poverty that exist in a society.

The core idea here is that the public good might be best served by raising basic living standards and ensuring access for all to quality food, shelter, health care, and infrastructure, rather than by trying to manage the spread between the richest and poorest. In essence, income inequality is not intrinsically bad for economic growth, and can actually be good—as long as there is opportunity for advancement. After all, financial rewards and the prospect of higher incomes are crucial for incentivizing entrepreneurs and innovation.

Against this backdrop, the new U.S. president should explore solutions to the challenge of income inequality over both short- and long-term horizons.

Those more concerned about relative income disparity tend to favor policy interventions that prioritize shorter-term interventions, such as income transfers or minimum wage laws. Often this requires greater taxation on higher-income earners (for transfers) or redistribution of company cash from shareholders to employees (in the case of minimum wage increases). However, such efforts to manage relative income-inequality concerns can discount the many benefits that the wealthy can contribute to economic growth: capital investment in new businesses, innovation, and ultimately job creation.

[I]ncome inequality is not intrinsically bad for economic growth, and can actually be good—as long as there is opportunity for advancement.

Those who subscribe to the view that public policy should be more focused on absolute poverty and raising a society’s average income levels tend to focus on longer-term public policy interventions, such as investments in education and infrastructure that seek to increase social mobility from lower to higher income levels.

According to the National Federation of Independent Business, small business owners cite the lack of qualified workers as a top business problem. Without improvements in job training and education, those at the bottom rung of incomes will have limited opportunity to change their incomes and economic situation. Thus investment in quality education (not just the quantity of dollars earmarked for it) is an area that could be important in the new presidential administration’s quest to address inequality.

In practice, both short- and long-term lenses are warranted, but both have real limitations. For example, many object to the idea of short-term policy interventions around income inequality because they worry about prioritizing individual consumption over beneficial societal investment. This is the perennial concern that income transfers disincentivize workers and come at a cost of reduced investment (as the marginal dollar that was earmarked for public infrastructure, education, or health care is redirected toward income transfers), which ultimately hurts the economy and the wider community at large.

Yet there is a real problem when the lower income strata in society cannot see a way to better themselves. In the past 30 years, for example, the probability has declined by more than half that a man born into the bottom 25 percent of the income distribution in the U.S. will end his life in the top 25 percent. Declining social mobility and worsening prospects for better incomes and an improving economic future for many families has shaken the underpinnings of the American dream. This in turn has undermined the stability and even legitimacy of the wider political and economic system.

4. The global consequences of slow growth

How, and whether, policy makers can create sustained economic growth is the fourth complicating factor in the income-inequality debate. Inasmuch as economic growth is needed to raise incomes, the prevailing global economic malaise offers little reason to be sanguine about improvements in income inequality in the foreseeable future.

There is a real problem when the lower income strata in society cannot see a way to better themselves.

Across emerging economies, where 90 percent of the world’s population lives, there are clear signs that economic growth has regressed below the 7 percent needed to double per capita incomes in one generation. Moreover, in many developing countries growth has stalled below the point where we can meaningfully continue to put a dent in poverty.

For example, many of the largest countries with populations of at least 50 million people, such as Brazil, Russia, and South Africa, are all growing significantly below the 7 percent threshold, and are in some cases contracting. For many such economies, the drag in economic growth is a direct consequence of declining global trade and falling demand for commodities they export, which in turn reflects slower growth in developed economies.

In the aftermath of the financial crisis, the world’s developed countries, including the U.S., continue to suffer under the weight of high debts and deficits, eroding quality and quantity of labor, and declining productivity. And capital, labor, and productivity are the three key engines of economic growth. In line with these deleterious trends, economic growth forecasts for advanced economies have stalled.

This worsening global economic picture has negative consequences for income as well as political inequality both within and between countries. Unfortunately, it will be a central characteristic of the world the new president faces. Widening inequality, whether income or political, provides fodder for political unrest, as the disaffected can see their prospects for better living standards and political freedom decline. After all, it would be foolhardy to expect that citizens can, over long periods of time, live cheek by jowl—the rich “haves” next to the poor “have-nots”—while the prospects and living conditions of the latter continue to deteriorate.

Widening inequality, whether income or political, provides fodder for political unrest.

Emerging evidence and trends make this issue even more urgent. A January 2016 Oxfam report highlights that the 62 wealthiest people in the world own as much wealth as the poorest half of the world's population. The 2015 “Forbes 400”—a ranking of U.S. wealth that lists the country's richest billionaires by their estimated net worth—revealed that with a combined worth of $2.34 trillion, the group owned more than the bottom 61 percent of the country combined.

Meanwhile in New York, the wealthy Upper East Side enclave (with median personal earnings of $60,000) borders the Bronx, the country’s poorest congressional district, where median personal earnings hover around $18,000. The U.S. Census Bureau found that approximately 38 percent of constituents in the Bronx district lived at or below the federal poverty line.

Such an enormous wealth divide can have a tremendous impact on political and social stability as well as on economic growth and prosperity. For instance, a recent IMF report argues that labor challenges and severe income disparity could lead to “a retrenchment from globalization and the emergence of a new type of fragile state.”

5. What the new president can do: technology as a solution

One need only look around the world—at the populist movements manifest in “Grexit” (the possibility of Greece leaving the European Union), the recent UK referendum vote to leave the EU (“Brexit”), and the U.S. presidential race, as well as political dissatisfaction in France, Germany, Spain, and elsewhere—to see the impact of widening income inequality and worsening social mobility on politics, the economy, and society as a whole.

The key to success lies in providing access to better education, infrastructure, and health care while developing new and innovative policies that maximize the potential of technology.

Reducing inequality requires clear, measurable, and specific solutions. For the next U.S. administration, technology offers a critical and key path to addressing the income-inequality challenge in an innovative way. In particular, technology advancements should be catalysts to tackle income inequality in at least two ways:

- Technology platforms such as the Internet and mobile phone applications can reduce entry barriers for individuals, enabling them to start and grow businesses. The incoming administration can capitalize on the advent of the digital age by keeping the regulatory burden and path to entry low and supporting a technology environment that fosters business development and job creation, which in turn raises the prospects of income and earnings for many millions of Americans. This path is particularly important since, at over 75 million strong, millennials (who have been born into this technology age) now represent the largest generation in the U.S. Technology and tech-based opportunities offer a path to generate incomes and ultimately reduce income inequality.

- The new administration should also use technological innovation to help small- and medium-sized businesses access capital. Such enterprises are the lifeblood of the American economy. The Small Business Entrepreneurship Council reports that as of 2013, small firms accounted for 63 percent of the net new jobs created in the preceding 20 years. Moreover, since the recession, small firms have accounted for 60 percent of the net new jobs, with firms with 20–499 employees leading the job creation. Yet in a recent survey of small business owners, Wakefield Research found that 70 percent of respondents reported “bureaucratic red tape” as hindering the growth of their business. Over 90 percent of the respondents also agreed that “the government should provide better resources to ensure that small businesses can get the capital they need.” The new administration thus has an opportunity to change the worsening income-inequality trend. By supporting technology-based crowdfunding—for example, by offering federal matching grants for funds raised through such initiatives—government can use technology to help small- and medium-sized businesses access the capital they need to drive the business growth, job creation, and income gains that together can reduce income inequality.

For the next U.S. president, the stakes surrounding income inequality are high. Reducing income inequality is an urgent and critical step in solving the social ills facing the world today. The key to success lies in providing access to better education, infrastructure, and health care while developing new and innovative policies that maximize the potential of technology to reduce inequality and enhance social mobility.